Personal Loans Canada Fundamentals Explained

Personal Loans Canada Fundamentals Explained

Blog Article

The 9-Minute Rule for Personal Loans Canada

Table of ContentsGet This Report about Personal Loans CanadaPersonal Loans Canada Can Be Fun For AnyoneTop Guidelines Of Personal Loans CanadaMore About Personal Loans CanadaThe Personal Loans Canada Diaries

Settlement terms at the majority of personal finance lenders range between one and 7 years. You receive all of the funds simultaneously and can use them for almost any objective. Borrowers commonly use them to fund an asset, such as a vehicle or a boat, pay off debt or assistance cover the price of a significant expense, like a wedding event or a home improvement.

Individual loans come with a fixed principal and passion month-to-month payment for the life of the car loan, determined by including up the principal and the rate of interest. A fixed rate provides you the safety and security of a foreseeable month-to-month settlement, making it a popular selection for combining variable price bank card. Payment timelines vary for personal loans, but consumers are commonly able to choose payment terms between one and seven years.

Little Known Questions About Personal Loans Canada.

You may pay an initial origination charge of up to 10 percent for a personal car loan. The cost is typically subtracted from your funds when you settle your application, lowering the quantity of money you pocket. Individual finances rates are extra directly connected to short-term rates like the prime price.

You might be supplied a lower APR for a shorter term, due to the fact that lenders recognize your equilibrium will be repaid quicker. They may charge a higher price for longer terms recognizing the longer you have a financing, the more most likely something can transform in your financial resources that might make the settlement expensive.

:max_bytes(150000):strip_icc()/pros-cons-personal-loans-vs-credit-cards-v1-4ae1318762804355a83094fcd43edb6a.png)

An individual financing is additionally a great alternative to using bank card, considering that you obtain cash at a fixed price with a definite benefit day based on the term you pick. Remember: When the honeymoon mores than, the regular monthly payments will certainly be a reminder of the cash you invested.

Not known Facts About Personal Loans Canada

Compare rate of interest rates, fees and lender track record before using for the car loan. Your debt score is a large variable in establishing your qualification for the financing as well as the interest rate.

Before using, recognize what your score is so that you know what to anticipate in regards to expenses. Watch for concealed fees and penalties by reviewing the loan provider's terms and conditions web page so you do not wind up with less money than you require for your economic goals.

They're much easier to certify for than home equity loans or various other safe lendings, you still require to reveal the loan provider you have the means to pay the lending back. Individual loans are better than credit history cards if you want a set regular monthly payment and require all of your funds at as soon as.

Not known Facts About Personal Loans Canada

Credit scores cards may also provide rewards or cash-back choices that individual loans do not.

Some loan providers might also bill fees for personal financings. Personal finances are finances that can cover content a number of personal expenditures.

, there's generally a set end day by which the funding will be paid off. An individual line of debt, on the other hand, may continue to be open and offered to you forever as lengthy as your account remains in excellent standing with your loan provider.

The cash obtained on the finance is not taxed. If the loan provider forgives the lending, it is thought about a terminated financial debt, and that quantity can be exhausted. Individual lendings might be safeguarded or unsecured. A protected personal car loan calls for some kind of security as a problem of loaning. For circumstances, you might safeguard an individual financing with cash properties, such as a financial savings account or deposit slip (CD), or with a physical asset, such as your automobile you could try these out or boat.

Personal Loans Canada Things To Know Before You Get This

An unsafe personal funding calls for no security to borrow money. Banks, credit report unions, and online lenders can offer both protected and unprotected individual financings to qualified customers.

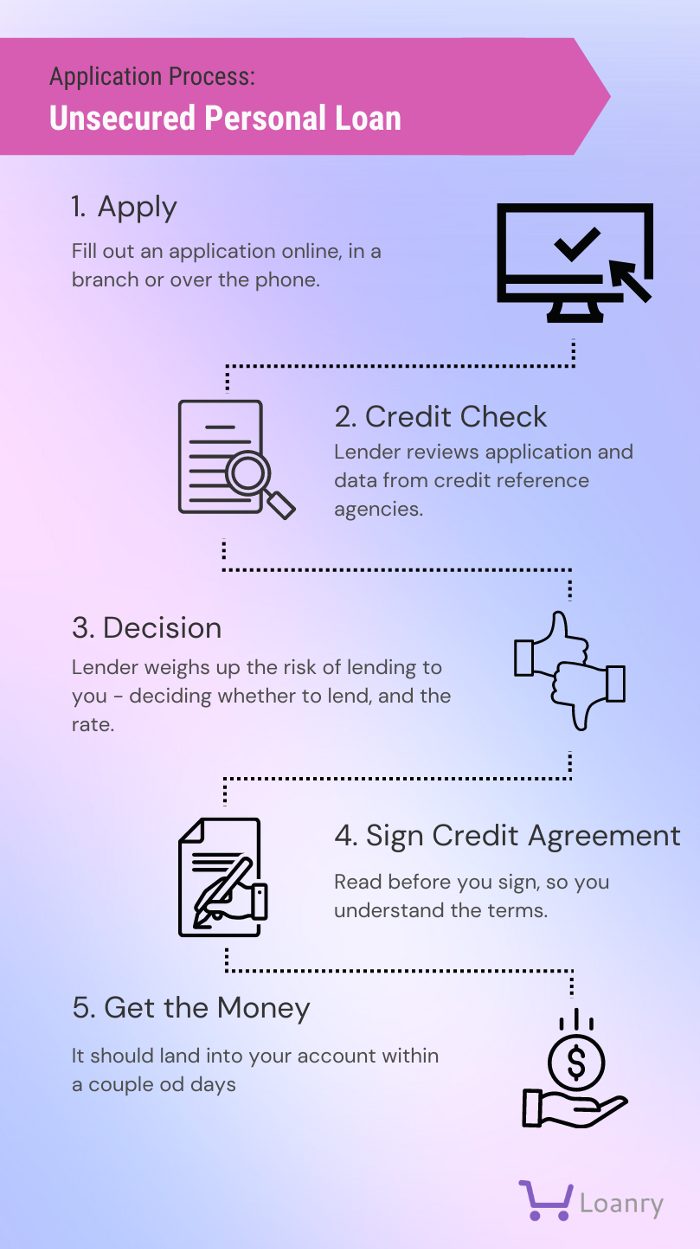

Again, this can be a bank, lending institution, or on-line personal finance lending institution. Usually, you would certainly first complete an application. The lender reviews it and chooses whether to accept or reject it. If authorized, you'll be provided the finance terms, which you can approve or turn down. If you concur to them, the following action is completing your funding documents.

Report this page